Cryptocurrencies have become increasingly popular as an investment option, but like any investment, they come with a certain level of risk. However, with the right risk management strategies, traders can mitigate these risks and improve their chances of success. In this article, we will explore some of the key risk management techniques that crypto traders can use to protect their investments.

Do Your Research

The first step to effective risk management is to do your research before making any investments. This means understanding the fundamentals of the cryptocurrency you are considering, as well as the broader market trends and factors that could impact its value. It is also important to research the exchange or platform where you plan to buy and sell your cryptocurrency, as some are more reputable and secure than others.

Set Realistic Goals

Another key aspect of risk management is setting realistic goals for your investments. This means determining your risk tolerance and identifying your long-term investment goals. By setting realistic expectations and sticking to your investment plan, you can avoid making rash decisions based on emotions or short-term market fluctuations.

Diversify Your Portfolio

Diversification is also important for managing investment risk. By investing in a range of different cryptocurrencies and other assets, you can spread out your risk and reduce the impact of any one investment on your overall portfolio. This can help to protect you against unexpected market events or volatility in specific markets.

Use Stop-Loss Orders

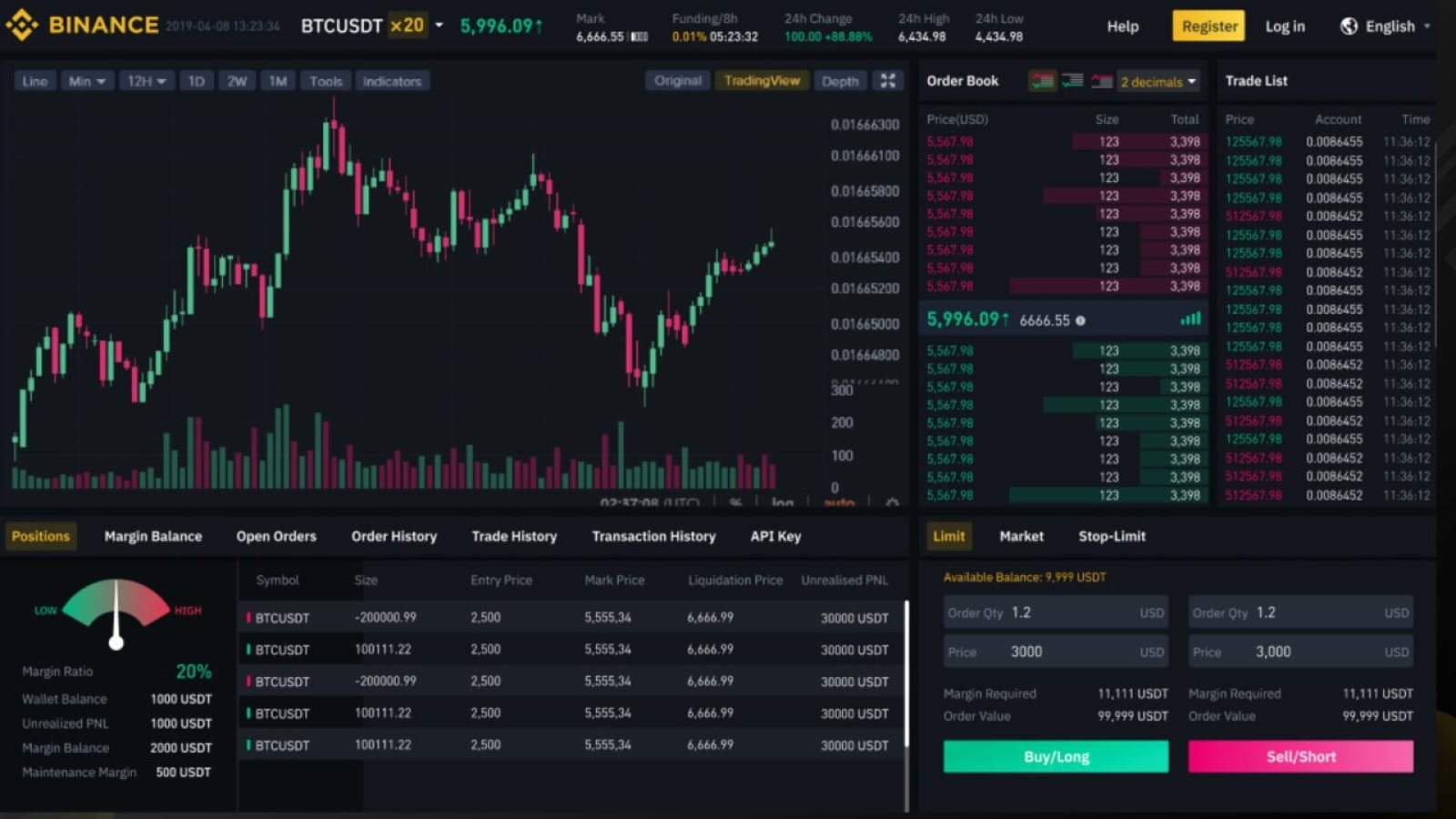

Stop-loss orders can also be an effective tool for managing risk. These orders automatically sell your cryptocurrency if it drops to a certain price, helping to limit your losses and protect your investment. This can be especially useful for traders who may not be able to constantly monitor the market or react quickly to sudden price drops.

Stay Informed

Finally, staying informed and up-to-date on market trends and news is crucial for effective risk management. This means regularly monitoring the cryptocurrency market and news sources for any potential developments or factors that could impact your investments. By staying informed, you can make more informed decisions about your investments and be better prepared to respond to changing market conditions.

See more about NFTs